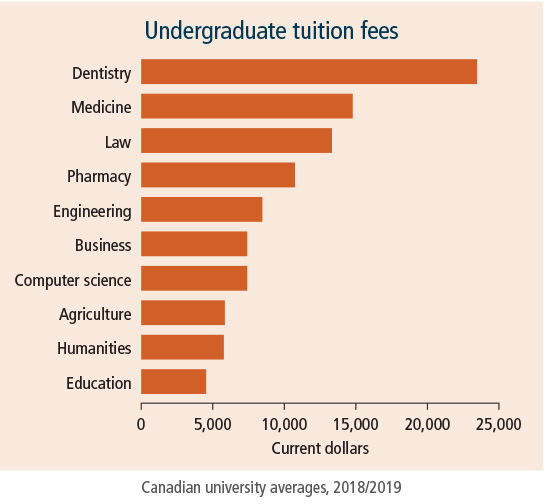

If a parent bases post-secondary education savings on average costs, the amount needed for tuition would be $6,838 for each academic year, based on the 2018/2019 average for Canadian universities.1 But what if the child decides to pursue dentistry? The average annual tuition for dentistry programs in Canada is $23,474.1

Or perhaps a parent isn’t up to date on campus costs these days. Most universities charge between $10,000 and $15,000 for a double room with a full meal plan.

Maybe your child will continue with grad school. Add more expenses for residence or apartment and tuition. If your child pursues a Master of Business Administration (MBA), the average annual tuition for a regular MBA in Canada is $30,570.2

It’s important to make sure you’re contributing enough to your Registered Education Savings Plan (RESP) and any other investment vehicles you may be using. Otherwise, extra funds to cover higher-than-expected costs might end up coming from your retirement savings.

Your RESP – a solid foundation

RESPs remain the foundation of education funding. Your contributions grow tax-deferred and you can contribute up to $50,000 for each child. You also receive the Canada Education Savings Grant (CESG), paid directly into the RESP. The government matches each contribution by 20%, up to $500 annually, to a maximum total of $7,200 for each child.

If you start contributing early and take full advantage of the annual grant, your RESP alone may meet your education savings goal. Some parents may choose to supplement an RESP with other investment vehicles to accumulate more education savings, or because they want a source of savings that can easily be used to meet other financial goals if not required to fund education.

Investing with an in-trust account

An in-trust account, sometimes called an informal trust, is a non-registered investment account you establish for one minor child. If you want to save for two children, you’ll need two such accounts. They’re easy to set up and can provide tax advantages. When you use an in-trust account for equity investing, capital gains are taxable to your child, which typically means paying little or no tax when withdrawals are made during university years. Interest and dividend income earned on original capital are taxable to you, but income earned on income is taxable to your child. You can invest as much as you wish annually and in total. These accounts have flexibility, as the funds don’t need to be used for education costs. Upon reaching the age of majority, the child may request the assets in the account or may choose to leave some or all of the assets in trust until a later date.

Using Tax-Free Savings Accounts (TFSAs)

Tax-free growth and tax-free withdrawals make a TFSA an ideal vehicle for education savings, and contributions can be considerable if you use both your and your spouse’s TFSAs. If you wish, once your child turns 18, you could give money to your child to contribute to her or his own TFSA. And as you withdraw funds for education costs from your own TFSA, you can re-contribute withdrawn amounts the following calendar year.

Many decisions are involved

Whether to supplement an RESP with other investments is only one of several decisions to make. If you have more than one child, you might also want to know if individual RESPs or a family plan suits you best. As teen years approach, you may wonder when you should make RESP investments more conservative. When it’s time to withdraw RESP funds for university costs, you’ll want to know about the strategies involved in accessing taxable funds versus non-taxable funds.

Please contact us to discuss any of the decisions that arise as you take care of the financial side of your children’s education.

Sources:

1. Statistics Canada, Table 37-10-0003-01, Canadian undergraduate tuition fees by field of study

2. Statistics Canada, Table 37-10-0004-01, Canadian graduate tuition fees by field of study