The traditional way of doing things isn’t always the most economical. Take the home phone. Many people hardly use their land line and would save money by only using their mobile phone. Sometimes we follow the same old habits without exploring alternatives.

When choosing life insurance, there’s a traditional way to determine the policy you purchase: assess how much coverage you need, how long you need it for, then buy the policy. So, if someone needs $500,000 of life insurance to protect the family for 20 years, purchase a Term 20 life insurance policy with a $500,000 insurance amount.

But there’s one significant fact this traditional method doesn’t take into account. Life insurance needs often decrease over time. That $500,000 20-year policy? Toward the end of the term, the policy owner may be paying for more coverage than needed.

The layering strategy

The layering strategy is an alternative way to more closely match insurance coverage to evolving life insurance needs. It can work at different stages of life, but here’s an illustration of one spouse in a young family to show the strategy’s full scope.

Sandra and Lorne, both 30, have a three-year-old daughter and a newborn son. Sandra is a software developer and the primary income earner. She needs life insurance to protect her family’s financial security – enough to help cover the family’s cost of living and education savings until the children are financially independent. They have a large mortgage and line of credit and very little education savings.

Sandra’s life insurance need is determined to be $450,000 of term life insurance for 25 years. But is the purchase of a $450,000 policy with a 25-year term Sandra’s best solution? Ten years down the road, Sandra won’t need $450,000 of protection. Education savings will be substantial, the mortgage balance will be lower, and as the children get older there’ll be fewer years of living costs to protect.

Only pay for what you need

Sandra can purchase two or more policies that begin now and last for different periods of time. She will have layers of coverage that provide full protection in early years, with reducing insurance amounts in later years to match decreasing needs.

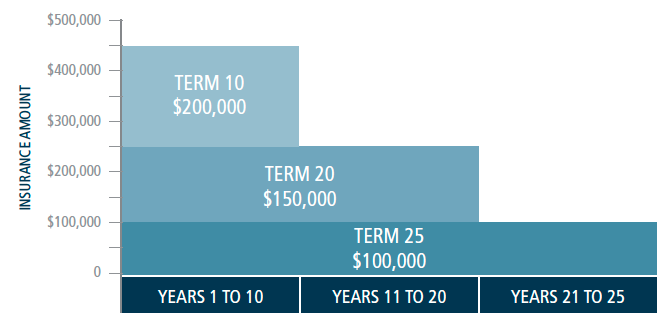

Sandra will have three term life policies – a $200,000 policy for 10 years, a $150,000 policy for 20 years and a $100,000 policy for 25 years. This gives her the $450,000 of coverage the family needs now. After 10 years, Sandra will have $250,000 of coverage, and she’ll have $100,000 of term insurance when her children are in university and on the road to financial independence. The layering strategy gives Sandra coverage that’s tailored to her evolving insurance needs, and she saves money on premiums over the years.

Talk to us if you want to review your temporary and permanent life insurance needs and find out the best – and most economical – way to protect your family’s financial security.

Sandra’s layered life insurance coverage