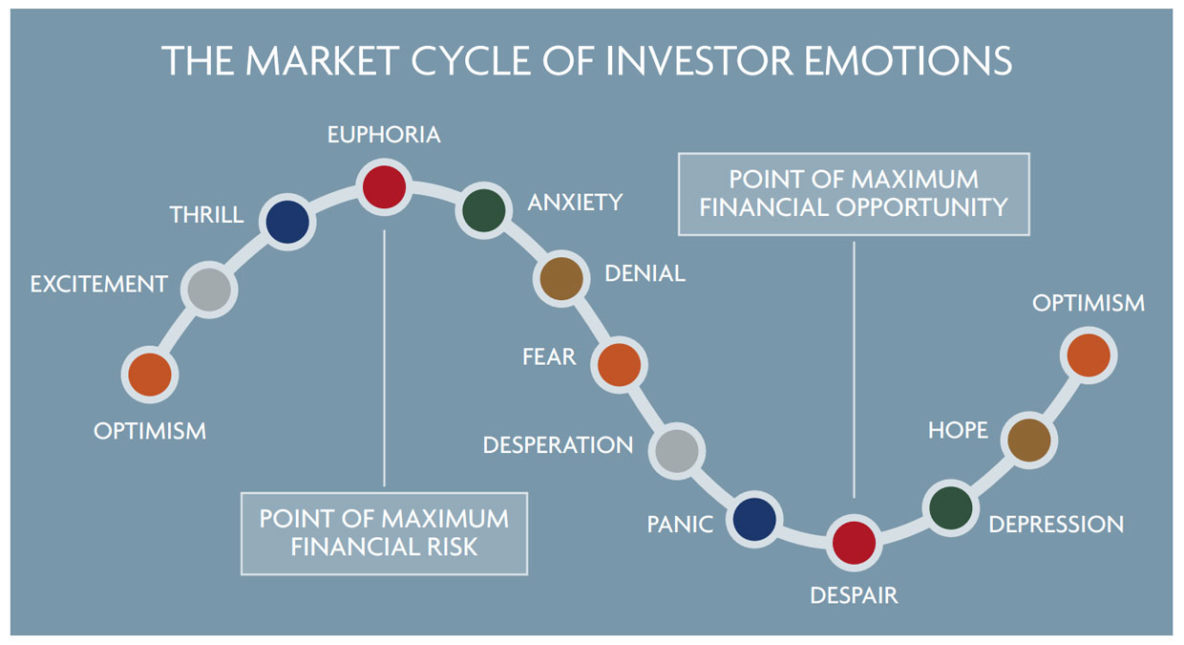

Often, it’s wise to trust our emotions, but something strange happens when it comes to investing. When markets soar, our emotions try to sway us to buy high, and when markets fall, our emotional response is to want to sell—the opposite of the “buy low, sell high” investment ideal. The chart shows the path of investment performance through a complete … Read More

IN THE WORLD OF INVESTING, TIME IS YOUR FRIEND

When you think of how time helps you achieve investment objectives, the first thing that comes to mind may be compound growth. You make an investment, reinvest your returns year after year, and continue to earn returns on both your original contribution and all of the accumulated returns. Given enough time, the value of the growth can exceed that of … Read More

BEWARE OF FRAUD TARGETING SENIORS

A person claiming to be a lawyer phones a targeted senior with an urgent request. Their grandchild crossed the border and got into legal trouble. They need $5,000 to avoid jail and said please don’t tell mom or dad. The grandparent scam is an old one that’s now making a resurgence across Canada. And there are a dozen or more … Read More

MANAGING FINANCIAL LIFE IN A SECOND MARRIAGE

According to Statistics Canada, more than one in four Canadians in a couple is in a second or subsequent marriage or common-law relationship. For most people getting together as a new couple, financial life will change. Here’s a look at several financial and wealth planning matters that may be different the second time around. YOURS, MINE AND OURS There are … Read More

LIFE DECISIONS AND THE FINANCIAL FACTOR

How do you make important life decisions? Make and evaluate a list of pros and cons? Discuss the matter with your spouse or a close friend? Trust your intuition? Everyone has their own style, and you might use different methods depending on the issue. Whichever method you use, you’ll probably find that many life decisions, in addition to all of … Read More

BUY LOW, SELL HIGH–THE CHALLENGES AND OPPORTUNITIES

Buy low, sell high is one of the most famous mantras in investing. It’s the investment ideal, if you could do it regularly and successfully. The trouble is, if you aim to buy low and sell high by trying to time the market, you’ll face conditions that are unpredictable. CHALLENGES OF MARKET TIMING Let’s start with selling high. What happens … Read More

CAN YOUR RISK TOLERANCE CHANGE?

Risk tolerance can be described in several ways, but it often comes down to this question: How much of a decline in the value of your investments are you comfortable accepting in exchange for higher potential returns over the longer term? For most people, risk tolerance doesn’t change—at least not until retirement nears. However, certain factors can make some individuals … Read More

TIME FOR A VACATION PROPERTY CHAT?

If you plan on passing down your cottage, cabin or chalet to your children, make sure they actually want to own the property. Finding out where everyone stands will prevent family conflicts down the road and help you with tax and estate planning. GAUGE YOUR CHILDREN’S INTEREST When you ask your child or children about eventually taking over the property, … Read More

SINGLE? ESTATE PLANNING IS STILL IMPORTANT

It’s natural to think that estate planning for a single person would be less involved than for someone who’s married with children. But that’s not necessarily the case. Many estate planning measures that are made automatically by a married individual, such as leaving estate assets to their spouse, require more time and thought for a single person. CHOOSING AN EXECUTOR … Read More

WHAT TO DO WHEN RETIREMENT APPROACHES

When retirement arrives, you want to enjoy this new chapter in your life – not start off with a multitude of financial decisions and to-dos. You can have comfort instead of chores by taking care of a few financial matters as retirement is approaching. ASSESS INSURANCE NEEDS When your working years end and you no longer receive group benefits from … Read More