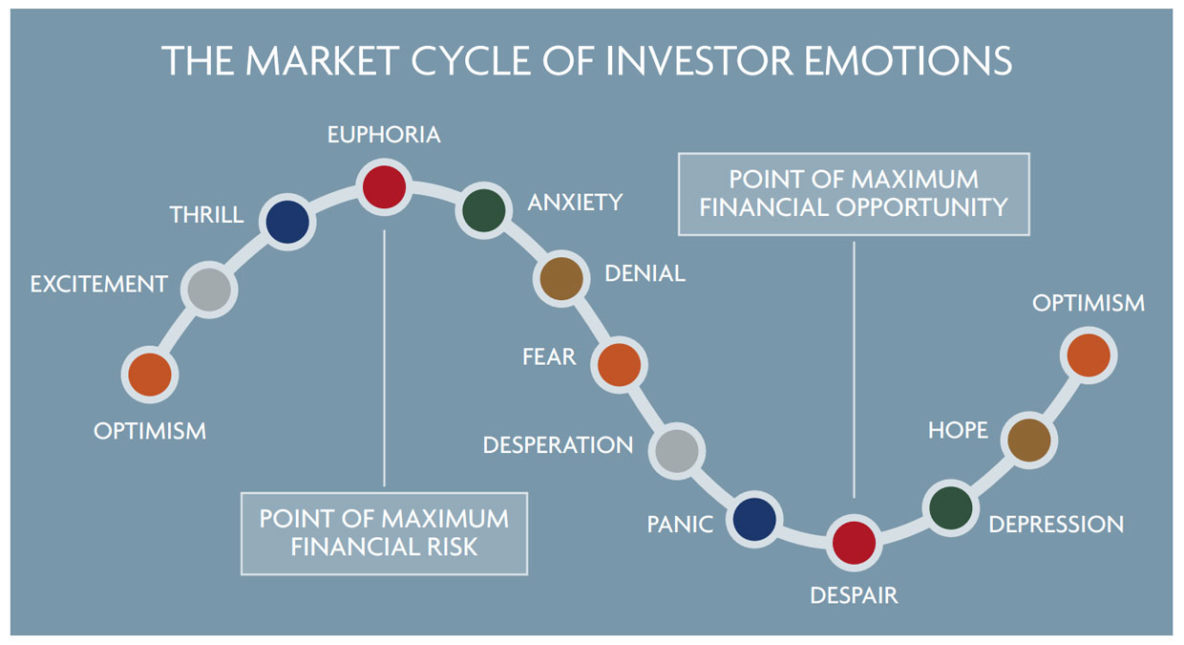

Often, it’s wise to trust our emotions, but something strange happens when it comes to investing. When markets soar, our emotions try to sway us to buy high, and when markets fall, our emotional response is to want to sell—the opposite of the “buy low, sell high” investment ideal.

The chart shows the path of investment performance through a complete market cycle, noting the investor emotions commonly triggered at each stage. Letting our emotions get the best of us can spell trouble in both the upswing and downswing.

THE PERILS OF TEMPTATION DURING A BULL RUN

Even though history tells us markets always have their ups and downs, it’s common in the midst of a long bull run to think, “this time, it’s different.” It can feel like we’ve reached a new era of ongoing economic growth, and our portfolio value will continue to climb—without the risk of a bear market or crash. Many investors experienced this emotional response in the prolonged bull run during the 2010s.

The danger is that an overly optimistic view can lead an investor to stray from their long-term plan. For example, a conservative investor could fall prey to the fear of missing out, load up on equities beyond their risk tolerance and become exposed to unnecessary anxiety and potential

losses when markets become volatile. Someone nearing retirement, unable to resist the temptation of high-flying markets, might invest savings in equities that they’d normally commit to fixedincome investments—putting their planned retirement date at risk.

THE SETBACKS ARISING FROM ACTING ON WORRY OR FEAR

The feeling of “this time, it’s different” can be just as powerful in down markets. When markets near or reach the bottom of the trough, investors may experience a sense of doom—that this time, markets won’t rebound.

Behavioural economists say that the psychological pain of a significant financial loss is twice as impactful as the joy of a financial gain. Some investors may have felt this gloom in the 2020 pandemic market crash, though it was short-lived, or during the global financial crisis of 2008 to 2010. Investors who worry that their life savings won’t ever recover to their former value can keep in mind that, even though past performance doesn’t guarantee future results, every correction or bear market has been followed by a recovery and, eventually, a bull market.

Acting on worry can be harmful financially. Selling assets turns a paper loss into an actual loss. Directing new contributions formerly designated for equities to fixedincome investments instead can put long-term financial goals at risk. Temporarily halting contributions sacrifices the

opportunity to purchase investments at a discount—and means accepting higher prices when eventually buying back in.

THE REMEDY FOR EMOTIONAL INVESTING

When markets enjoy an upswing, be content that you’re prospering. When markets are in correction mode, be patient. It’s always best to stick to your investment strategy throughout the market cycle. A fully diversified portfolio helps smooth out portfolio performance. Meanwhile,

making regular contributions ensures that you won’t over-invest when prices are higher, and you’ll purchase investments at a discount when prices are lower. It’s the tried-and-true principles that keep you on track to achieving your long-term financial objectives.