If you haven’t experienced it already, you may one day. A friend or relative is in dire straits and asks you for a loan. In some cases your instincts might tell you right away how you feel about the request. If the person is a loved one with a genuine need you may be only too glad to help out. … Read More

When Life Changes, So Do Financial Plans

Life is what happens to you while you’re making other plans, the saying goes. We just never know when the unexpected may happen. Here are four scenarios that look at various life changes and how financial plans adapt to evolving needs. Tara launches a business After 20 years in management, Tara lost her job in a reorganization. Her friends, who … Read More

RRSPs for Owners of a Business

If you want to make tax-deferred investments in an RRSP, you would draw a salary from your corporation to gain earned income that creates RRSP contribution room. Or you can save for retirement, also on a tax-deferred basis, by leaving excess funds in an investment portfolio within the corporation – eventually to be withdrawn as dividends. Each option has its … Read More

Are RRSPs Still The Best Choice?

In retirement, there’s a tax-saving strategy called “topping up to bracket.” It’s used when funds in a Registered Retirement Savings Plan (RRSP) or a Registered Retirement Income Fund (RRIF) will eventually be withdrawn when you’re in a higher tax bracket. The idea is to withdraw funds from your RRSP or RRIF in an amount that takes you to the upper … Read More

The Investment Factor You Can Control

You can’t control the direction of the markets or the return on your investments, but you have complete control over the amount you save and invest. And the amount you regularly invest may be the difference in meeting your financial objectives or not. Here’s a look at some life situations that typically call for investing more. Stay on track When … Read More

Avoid a financial hangover with these smart holiday spending tips | Financial Post

Planning your holiday spending means not just budgeting for gifts for loved ones, but also the myriad other holiday expenses. Read More

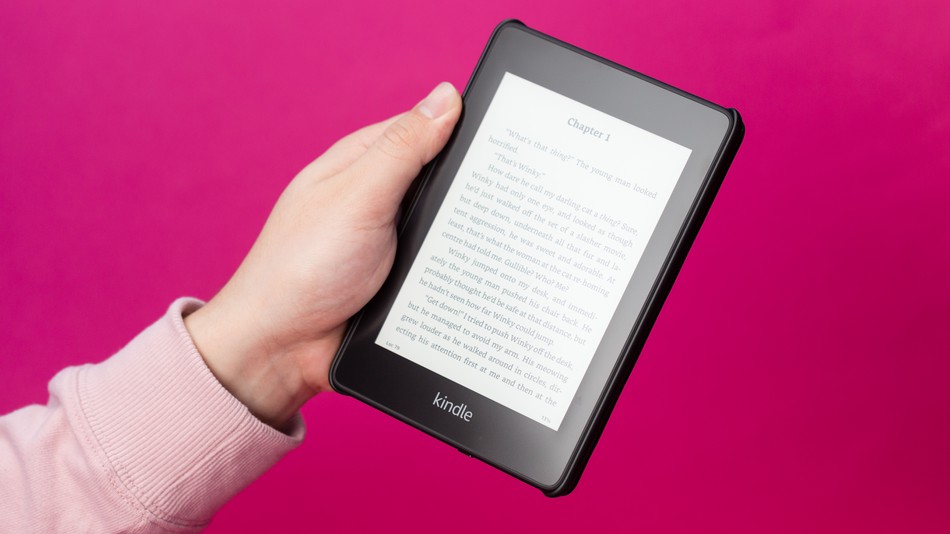

Amazon Kindle Paperwhite Review: The best e-reader for your money

If you spend a lot of time in airports or on the road, you quickly realize it’s better to travel with fewer electronic devices in your luggage. One of the great exceptions to this rule is the Amazon Kindle e-readers. They’re made to last for weeks on a single charge, and store a huge library of books, so that you … Read More

Plan Now to Minimize OAS Clawback Later

Ever wonder if you’ll be affected by Old Age Security (OAS) clawback? To give you an idea, OAS benefits are reduced for the July 2018 to June 2019 period when net income for 2017 exceeds $74,788. To minimize OAS clawback, you need to reduce net income. During retirement, an effective strategy is splitting pension income. But several strategies, including the … Read More

Invest Wisely and Sleep Well at Night

If you want to sleep well even when markets are volatile, you must invest according to your own risk tolerance. It’s one of the most important factors in investing. Also important, however, is that risk tolerance isn’t something you set and forget. It can change over time because of personal experiences or evolving life situations. Market cycle reaction At first, … Read More

The Estate Freeze

The key reason to use an estate freeze is to minimize the capital gains tax liability on assets left to children. It’s typically used when transferring a family business to the next generation. Capital gains on an owner’s interest in the company become taxable in the year of the owner’s passing. A significant tax bill could be a hard hit … Read More